Thought I’d take a moment to review the currency exchange card I have been using on my current France trip. I opened the account a while back when the company was called Transfer Wise but it’s now just Wise. I think from memory it was free and I joined via the app.

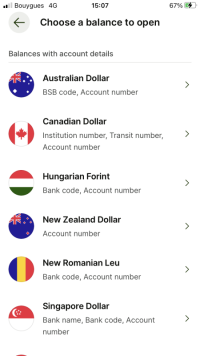

The card allows you to open upto 40 different currency accounts; I have Sterling, Euro and Dollar

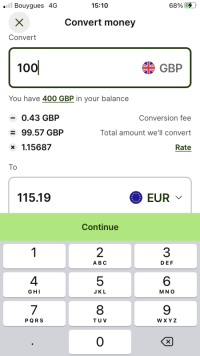

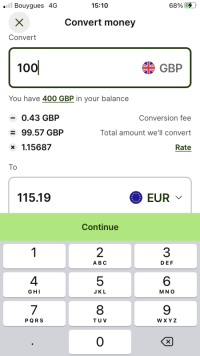

The cost for changing money is low; to change £100 to euros today would cost me 43 pence and the exchange rate would be 1.15687 which is very competitive.

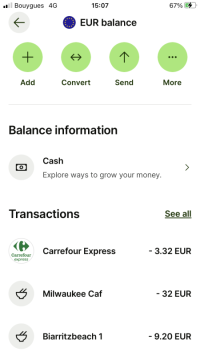

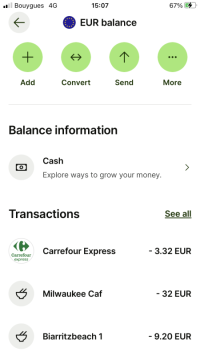

When using the card in France via an atm or a pin machine my euro account gets deducted the exact amount of euros I have spent, no fees from my euro account.

The transaction gets notified to me immediately so I know before I leave the bar if I have been had over. You can download statements etc like any other online account

Each currency account you open gets it’s own account number so if someone needs to pay you euros from a euro country or you need to buy something online in euros you can do so without worrying about exchange rates. You can transfer money back to your Sterling account whenever the rate is favourable. The uk account is protected by the fca rules. It’s been great on this trip - hope this helps peeps looking for an easy way to transfer foreign exchange

The card allows you to open upto 40 different currency accounts; I have Sterling, Euro and Dollar

The cost for changing money is low; to change £100 to euros today would cost me 43 pence and the exchange rate would be 1.15687 which is very competitive.

When using the card in France via an atm or a pin machine my euro account gets deducted the exact amount of euros I have spent, no fees from my euro account.

The transaction gets notified to me immediately so I know before I leave the bar if I have been had over. You can download statements etc like any other online account

Each currency account you open gets it’s own account number so if someone needs to pay you euros from a euro country or you need to buy something online in euros you can do so without worrying about exchange rates. You can transfer money back to your Sterling account whenever the rate is favourable. The uk account is protected by the fca rules. It’s been great on this trip - hope this helps peeps looking for an easy way to transfer foreign exchange

Last edited: